concord ca sales tax rate 2020

The December 2020 total local sales tax rate was 8250. The minimum combined 2022 sales tax rate for Commerce California is 1025.

Origin Based And Destination Based Sales Tax Rate Taxjar

This rate includes any state county city and local sales taxes.

. California state sales tax. This includes the rates on the state county city and special levels. Average Sales Tax With Local.

The County sales tax rate is 025. -025 lower than the maximum sales tax in CA. Some areas may have more than one district tax in effect.

Rates include state county and city taxes. It was approved. You can print a 975 sales tax table here.

There are approximately 2292 people living in the Concord area. The average cumulative sales tax rate in Concord Pennsylvania is 6. Q4 2019 Contra Costa County Sales Tax Update 0 1000 2000 3000 4000 SALES PER CAPITA.

This is the total of state and county sales tax rates. The Contra Costa County Sales Tax is collected by the merchant on all. 2020 rates included for use while preparing your income tax deduction.

Higher sales tax than 88 of California localities. Free Unlimited Searches Try Now. You can print a 55 sales tax table here.

The Contra Costa County sales tax rate is. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Lowest sales tax NA Highest sales tax 1075 California Sales Tax.

Concord NC Sales Tax Rate. Those district tax rates range from 010 to 100. Cool CA Sales.

The County sales tax rate is 025. 1788 rows California City County Sales Use Tax Rates effective April 1. 2020 rates included for use while preparing your income tax deduction.

The 975 sales tax rate in Concord consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Concord tax and 25 Special tax. There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. The Concord Illinois sales tax is 625 the same as the Illinois state sales tax.

Type an address above and click Search to find the sales and use tax rate for that location. Concord Measure V was on the ballot as a referral in Concord on November 3 2020. Ad Get California Tax Rate By Zip.

Next to city indicates incorporated city City Rate County Acampo. Please ensure the address information you input is the address you intended. The Concord Sales Tax is collected by the merchant on all qualifying sales made within Concord.

Acton 9500 Los Angeles Adelaida. The 94595 Walnut Creek California general sales tax rate is 825. The minimum combined 2020 sales tax rate for Contra Costa County California is 825This is the total of state and county sales tax rates.

The 53 sales tax rate in Concord consists of 43 Virginia state sales tax and 1 Appomattox County sales tax. The California sales tax rate is currently 6. What is the sales tax rate in Contra Costa County.

While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected. District 202021 Tax Rate Maturity Acalanes Union 1997 00107 2023-24. Contra Costa County sales tax.

Did South Dakota v. The 55 sales tax rate in Concord consists of 55 Nebraska state sales tax. There is no applicable city tax or special tax.

The current total local sales tax rate in Concord NC is 7000. The latest sales tax rates for cities starting with C in California CA state. The sales tax rate does not vary based on zip code.

Concord is located within Franklin County Pennsylvania. The minimum combined 2022 sales tax rate for Contra Costa County California is. 07 lower than the maximum sales tax in VA.

The latest sales tax rate for Contra Costa County CA. This rate includes any state county city and local sales taxes. The combined rate used in this calculator 825 is the result of the California state rate 6 the 94595s county rate 025 and in some case special rate 2.

There is no applicable county tax city tax or special tax. Sales Tax Calculator. This is the total of state county and city sales tax rates.

California City and County Sales and Use Tax Rates Rates Effective 01012020 through 03312020 Note. The 2018 United States Supreme Court decision in South Dakota v. The Commerce sales tax rate is 075.

An alternative sales tax rate of 7 applies in the tax region Pike which appertains to zip code 30206. The sales tax jurisdiction name is Dixon which may refer to a local government division. What is the sales tax rate in Commerce California.

The statewide tax rate is 725. Sellers are required to report and pay the applicable district taxes for their taxable. The Concord California sales tax is 875 consisting of 600 California state sales tax and 275 Concord local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc.

The latest sales tax rate for Concord NC. What is the sales tax rate in Concord California. City of Concord 975 City of El Cerrito 1025 City of Hercules 925 City of Martinez 975 Town of Moraga 975 City of Orinda 975.

Concord CA Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc.

5 digit Zip Code is required. The minimum combined 2022 sales tax rate for Concord California is 975. 02000 Concord 03000 El Cerrito 04000 Hercules 05000 Martinez 06000 Pinole 07000 Pittsburg 08000 Richmond 09000 Walnut Creek 10000 Brentwood 11000 San Pablo 12000 Pleasant Hill.

2 lower than the maximum sales tax in NE. A yes vote supported authorizing an extension and increase to the current sales tax from 05 to 1 generating an estimated 27 million per year for city services including emergency response disaster preparedness local businesses street. How 2019 Sales taxes are calculated for zip code 94595.

The sales tax jurisdiction name is Campbell County which may refer to a local government. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes. CA Sales Tax Rate.

Higher sales tax than 71 of Virginia localities. This is the total of state county and city sales tax rates. San Luis Obispo.

The Concord Georgia sales tax rate of 7 applies in the zip code 30206. The current total local sales tax rate in Concord CA is 9750. The tax rate given here will reflect the current rate of tax for the address that you enter.

The California sales tax rate is currently 6. The California state sales tax rate is currently. The December 2020 total local sales tax rate was also 7000.

Concow CA Sales Tax Rate. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. Within Concord there is 1 zip code with the most populous zip code being 17217.

The Concord Sales Tax is collected by the merchant on all qualifying sales.

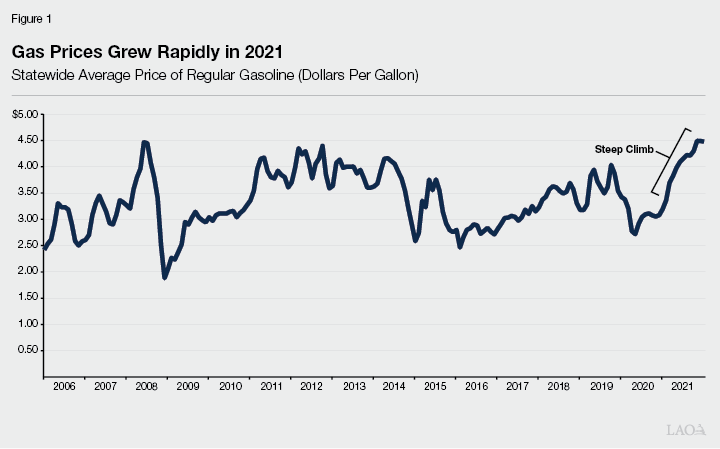

The 2022 23 Budget Fuel Tax Rates

California Sales Tax Guide And Calculator 2022 Taxjar

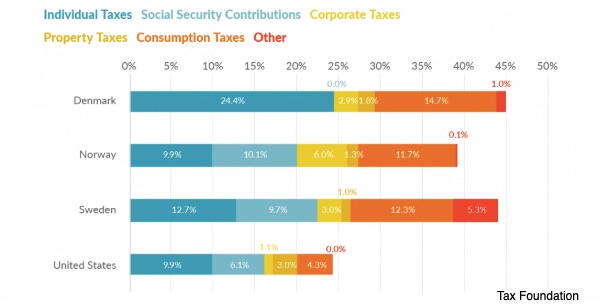

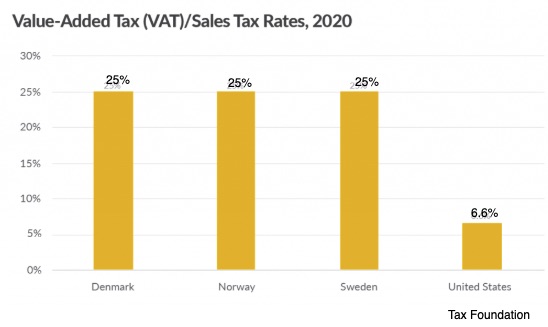

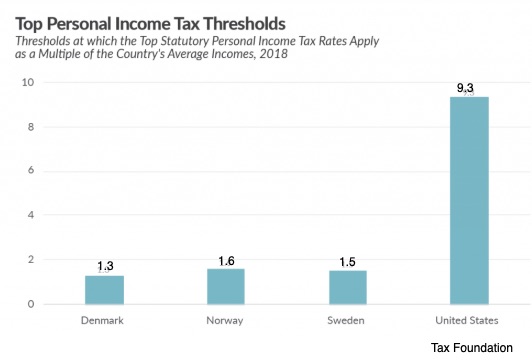

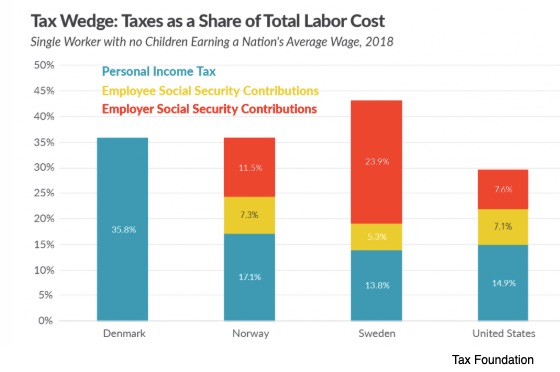

The Scandinavian Taxes That Pay For Their Social Programs

North Carolina Sales Tax Rates By City County 2022

California Sales Tax Guide And Calculator 2022 Taxjar

The Scandinavian Taxes That Pay For Their Social Programs

California Paycheck Calculator Smartasset

Texas Sales Tax Rates By City County 2022

How Much Is California Dispensary Sales Tax Breakdown

Georgia Sales Tax Rates By City County 2022

The Scandinavian Taxes That Pay For Their Social Programs

Si Quieres Tener Maximo Rendimiento En Tus Taxes Llama Ya A Rosario Experta En Income Tax Al 925 825 5627 O Visitanos En El 1955 Monumental Blvd S Cool Pictures

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global

The Scandinavian Taxes That Pay For Their Social Programs

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax