california property tax payment plan

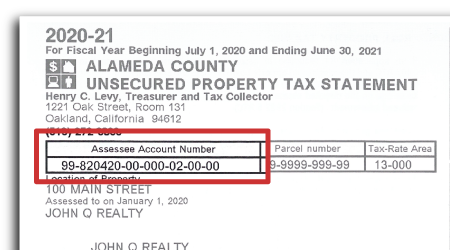

Some secured escaped assessment tax bills and unsecured business property or vessel escaped assessment tax bills may be eligible to be paid. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at.

Installment Agreement Tabb Financial Services

Credit and Debit Card service fees are non-refundable and cover.

. No fee for an electronic. Website Accessibility Certification Agency California. If you have any questions regarding this Payment Plan please call the Tax Collectors Office Secured Property Tax Unit between 900 am.

County of Los Angeles Treasurer and Tax Collector. You can pay online by credit card or by electronic check from your checking or savings account. This office is also responsible for the sale of property subject to.

Room 101 E Visalia CA 93291. Post Office Box 512102. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

Monday through Friday excluding. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to. You may be required to pay electronically.

The current taxes must be paid timely each year by the due dates. The Riverside County Treasurer-Tax Collector is responsible for the billing and collection of property taxes and for the receiving processing investing and most importantly safeguarding. This page provides information on how to view and pay your.

Each online creditdebit card transaction is limited to 9999999 including a service fee of 222 percent of the transaction. This plan provides a means of paying secured. Pay your tax bill online by electronic check eCheck with no service fee by entering in your checking account information.

A convenience fee of 25 will be charged for a credit card transaction. Escaped Assessment Payment Plans. The payments are payable over a four-year period as per California Revenue and Taxation Code.

If a payment is not paid timely all penalties interest and other charges will become due and payable. For prior year secured property tax delinquencies a property owner may initiate an installment plan of redemption to redeem the property. You may also pay online by using major credit cards or debit cards.

You may mail your completed application and payment to the address below. 559-636-5280 221 South Mooney Blvd. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County.

File a written request with the Tax Collectors office prior to the due date of the bill.

Property Tax Calculator Smartasset

Property Tax Alert Brigit S Barnes Associates Inc Facebook

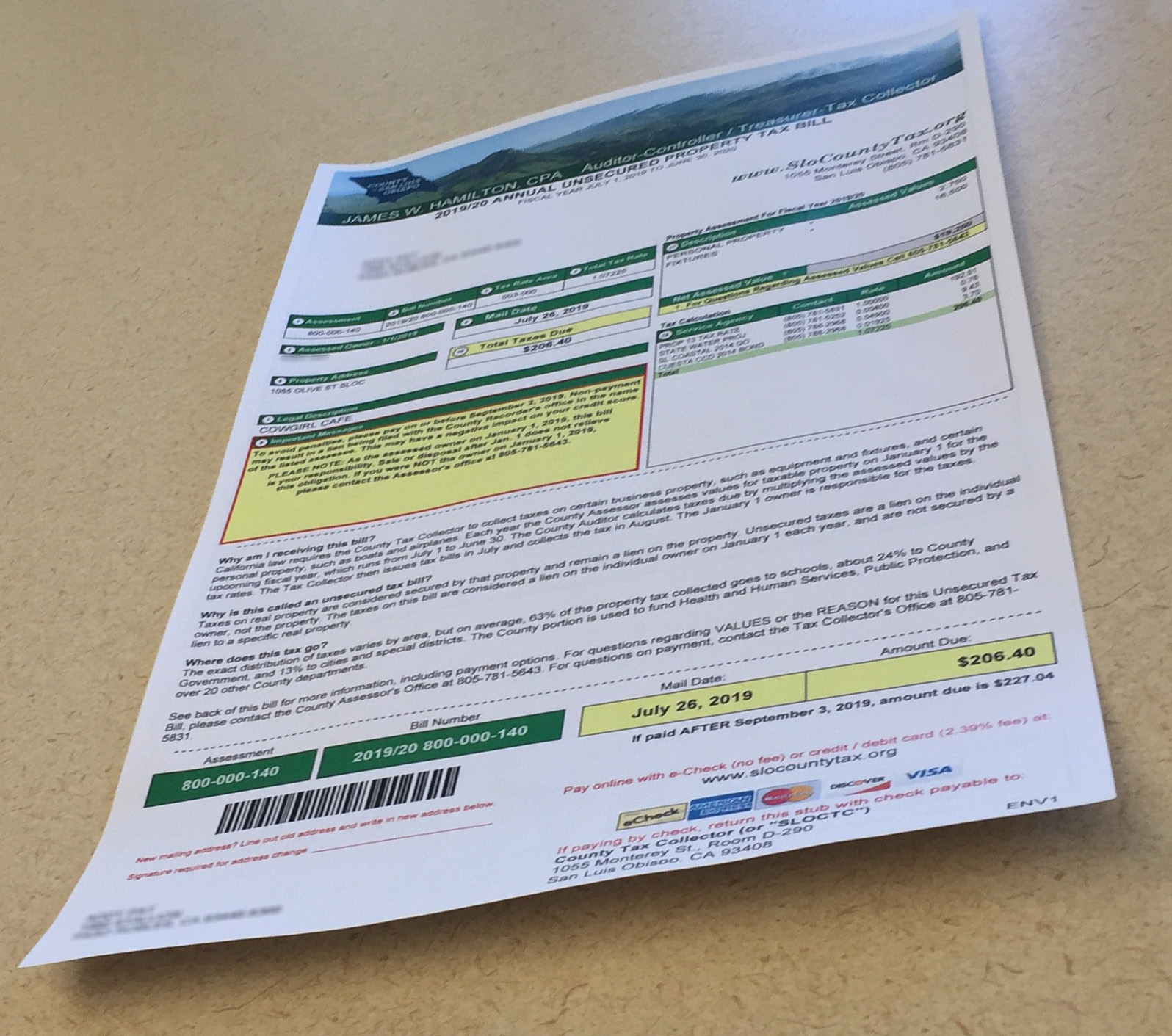

Tax Collector County Of San Luis Obispo

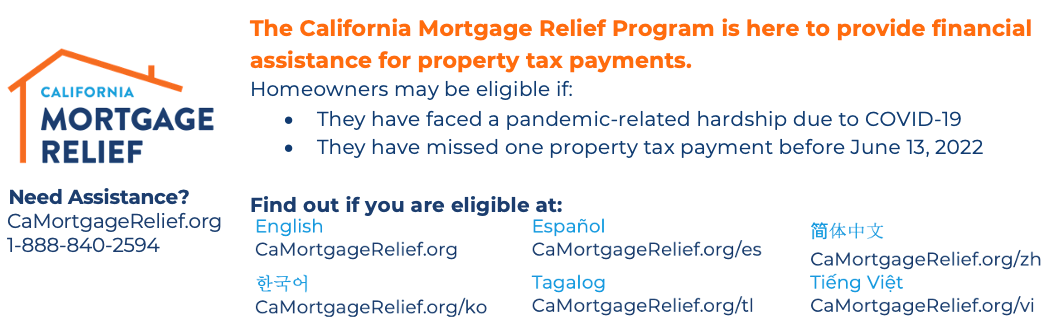

Program Helping California Residents Struggling With Mortgage And Property Tax Payments Abc30 Fresno

Property Tax Installment Plans Treasurer And Tax Collector

Property Tax Payment Treasurer Tax Collector

Tangible Personal Property State Tangible Personal Property Taxes

Monterey County Property Tax Guide Assessor Collector Records Search More

What You Should Know About Property Taxes In California Nicki Karen

California Prop 19 Property Tax Changes Inheritance

Kern County Treasurer And Tax Collector

Solano County Assistance Programs

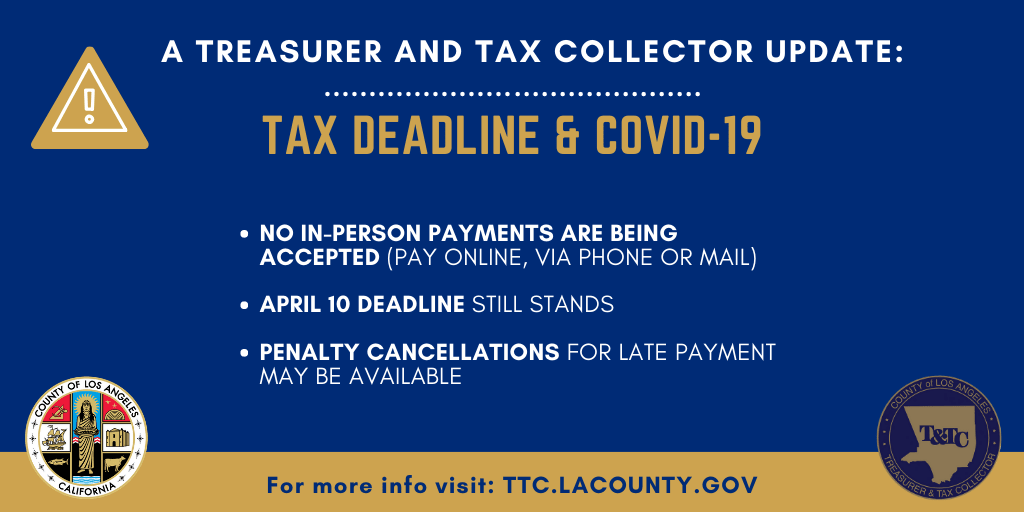

Property Tax Payments Can T Be Postponed But Late Fees May Be Waived Times Of San Diego

Property Tax Payments At Law Office Of David Lee Rice

What California Homeowners Should Know About Supplemental Tax Bills Quicken Loans